Disclaimer - These IBKR sessions are for training and research purpose only. Please consult your investment advisor before making any investment decisions.

Use Case

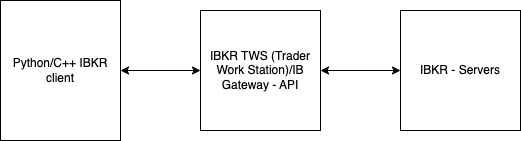

Sample usage of IBKR Python API

- Use Python API and IBKR paper trading account to test some trading strategies

- IBKR C++ API (For basic trading Python API should be sufficient)

References

Dataflow Diagram

Source Code

- https://interactivebrokers.github.io/index.html (Downloadable zip file)

- https://interactivebrokers.github.io/api_software_contribute.html (Sign collaborator agreement and get readonly access to the API on github)

- Docker Compose Update

Session 1:

- Topics Discussed:

- Start the IBKR API container in docker

- Using VS Code remote development run the API test samples

- Place SPY Limit and Market Orders

- Cancel the placed Limit and Market Orders

Video explanation of the code

Session 2:

- Topics Discussed:

- Fetch Stock Details

- Fetch Future Details

- Fetch Option Contract Details

Video explanation of the code

Source Code

Session 3:

- Topics Discussed:

- Order Create

- Order Query

- Order Update

- Order Cancel

- Order Global Cancel

Video explanation of the code

Source Code

References

Reference - IBKR Python API Videos

Session 4:

- Topics Discussed:

- Advanced Orders

- Bracket Order

- Combo Order

- Advanced Orders

Video explanation of the code

Source Code

Session 5:

Use Case

Create a short list of instruments based on a theme:

- Show contracts with the highest percent price increase between the last trade and opening price

- Most Active by Volume

- Options by Put/Call volume/open interest ratio

- Many scenarios are supported per IBKR API Guide

- Topics Discussed:

- Market Scanner:

- Request Market Scanner Parameters

- Request stocks with the highest percent price INCREASE between the last trade and opening prices

- Request US Traded futures

- Market Scanner:

Video explanation of the code

Source Code

References

IBKR Python API Videos

IBKR API Reference Guide

Query Contract Details