Options Trading

The Options page provides a powerful platform for analyzing stock and ETF options chains. With comprehensive data including strike prices, expiration dates, Greeks (Delta, Gamma, Theta, Vega, Rho), and volume metrics, traders can make informed decisions about their options strategies.

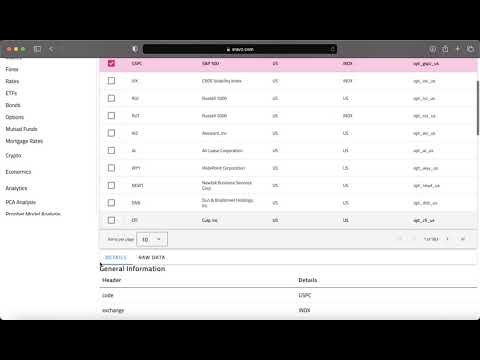

- Live Dashboard: Options Chain

Dashboard Overview

The Options dashboard features a modern analytics-first design with real-time options data:

Summary Analytics

When viewing an underlying asset’s options chain:

- Call Options - Total number of call contracts available

- Put Options - Total number of put contracts available

- Put/Call Ratio - Market sentiment indicator

- Expiry Dates - Number of available expiration dates

Key Features

1. Underlying Asset Selection

Search and select from available stocks and ETFs:

- Quick Search - Find assets by ticker symbol or name

- Exchange Information - View listing exchange for each asset

- Instant Loading - Options data loads immediately upon selection

2. Options Chain Data

Comprehensive options chain display including:

Call Options

- Contract name and details

- Strike price and premium

- Bid/Ask spread

- Volume and open interest

- Implied volatility

- Full Greeks suite

Put Options

- Complete put contract data

- Same metrics as calls

- Easy comparison view

3. Options Greeks

All standard Greeks for risk analysis:

| Greek | Description | Use Case |

|---|---|---|

| Delta | Price sensitivity to underlying | Directional exposure |

| Gamma | Delta’s rate of change | Acceleration risk |

| Theta | Time decay | Daily premium erosion |

| Vega | Volatility sensitivity | IV exposure |

| Rho | Interest rate sensitivity | Rate change impact |

4. Additional Metrics

- Implied Volatility - Market’s expected volatility

- Intrinsic Value - In-the-money amount

- Time Value - Premium above intrinsic

- Theoretical Price - Model-based fair value

- Days Before Expiration - Time until expiry

Options Data Structure

Contract Information

Each option contract includes:

- Contract Name - Full option identifier

- Contract Size - Number of shares per contract (usually 100)

- Contract Period - Weekly, monthly, or LEAPS

- Currency - Trading currency

- Type - Call or Put

- In The Money - ITM/OTM status

Market Data

- Last Trade DateTime - Most recent trade timestamp

- Last Price - Most recent trade price

- Bid/Ask - Current market quotes

- Change/Change% - Price movement

- Volume - Daily trading volume

- Open Interest - Outstanding contracts

Use Cases

1. Options Trading Decisions

Review comprehensive options data before executing trades:

- Compare premiums across strike prices

- Analyze Greeks for risk management

- Identify high-volume contracts for liquidity

2. Volatility Analysis

Study implied volatility patterns:

- Compare IV across expiration dates

- Identify volatility skew

- Assess put/call IV disparities

3. Strategy Planning

Plan multi-leg options strategies:

- Covered calls

- Protective puts

- Spreads (vertical, calendar, diagonal)

- Iron condors and butterflies

4. Risk Assessment

Evaluate position risks:

- Delta exposure for directional risk

- Gamma risk near expiration

- Theta decay for time-sensitive positions

- Vega exposure to volatility changes

Data Visualization

The platform displays options data in multiple formats:

Grid View

- Organized tabular display of all contracts

- Sortable by any column

- Filter by strike price or expiration

Graphical Analysis

- Option metrics by expiry date

- Option price by strike price

- Visual put/call comparison

Video Tutorial

Watch the complete walkthrough of the Sravz Options page:

Screenshots

Options Dashboard

Technical Details

Data Model

The options data structure includes:

Option Ticker

SravzId- Unique identifierTicker- Trading symbolCode- Asset codeExchange- Listing exchangeCountry- Market countryName- Full asset name

Options Chain Data

lastTradeDate- Latest trade datelastTradePrice- Underlying’s last pricedata[]- Array of expiration date data

Expiration Data

expirationDate- Option expiryimpliedVolatility- Average IVputVolume/callVolume- Trading volumeputCallVolumeRatio- Volume ratioputOpenInterest/callOpenInterest- OI metricsoptionsCount- Total contractsoptions.CALL[]/options.PUT[]- Contract arrays

Related Pages

- Stocks - Underlying equity research

- ETFs - ETF options underlyings

- Market Index - Index options reference

- Fundamentals - Underlying analysis