Charts

The Charts page provides comprehensive visualization tools for analyzing financial assets across multiple dimensions. Access real-time data, historical trends, and technical analysis all in one place.

Supported Asset Types

| Asset Type | Description |

|---|---|

| Corporate Bonds | Investment-grade and high-yield corporate debt |

| Government Bonds | Treasury and sovereign debt instruments |

| Commodities | Physical goods (gold, oil, agricultural) |

| Common Stock | Equity shares of publicly traded companies |

| Currencies | Forex pairs and crypto currencies |

| Futures | Derivative contracts for future delivery |

| Indices | Market benchmarks (S&P 500, NASDAQ, etc.) |

| Rates | Interest rates and yield curves |

Chart Types

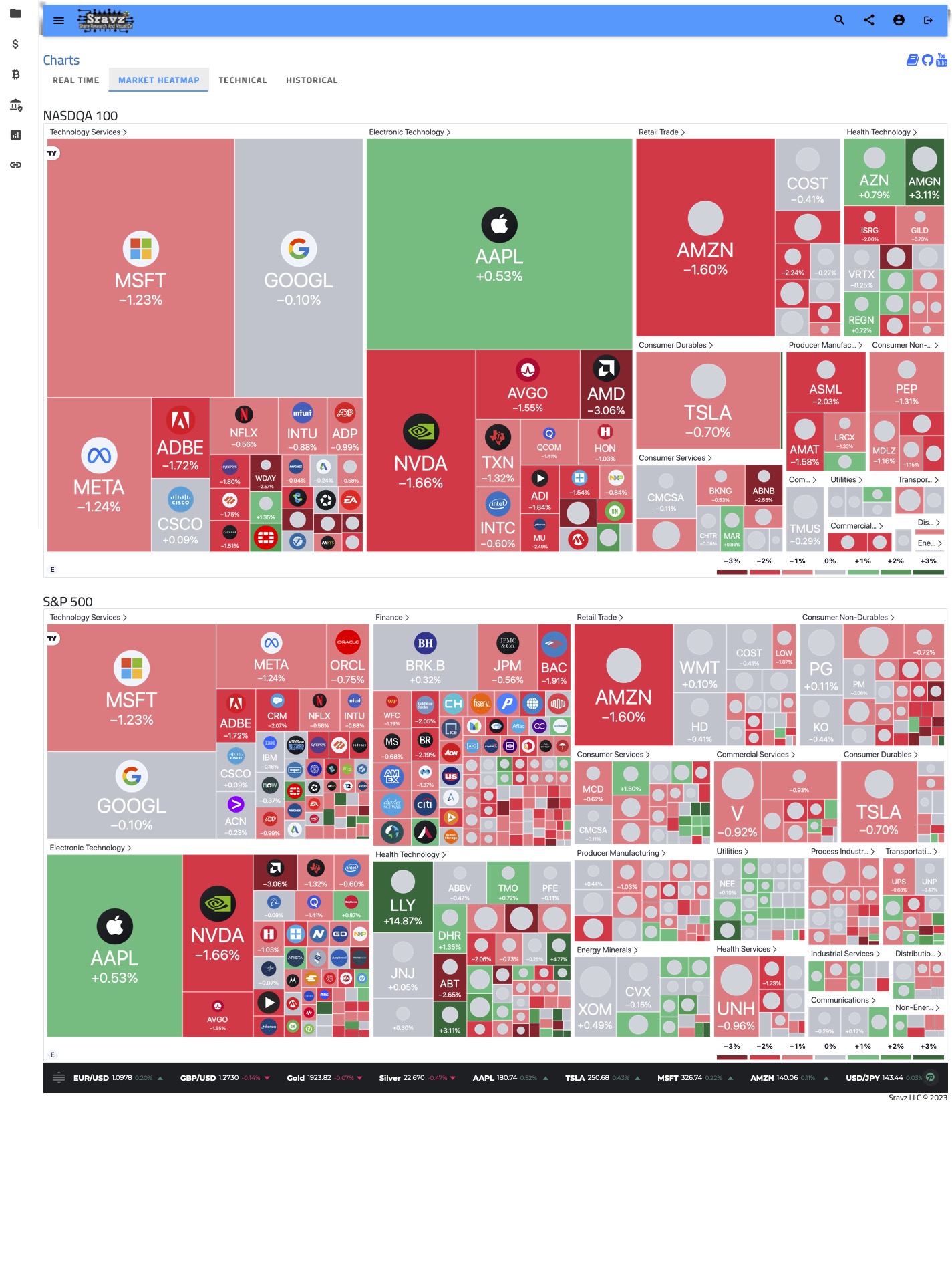

🗺️ Market Heat Map

Visualize market performance at a glance with color-coded heat maps showing gainers and losers across sectors.

Features:

- NASDAQ 100 companies

- S&P 500 companies

- Sector-level aggregation

- Real-time updates

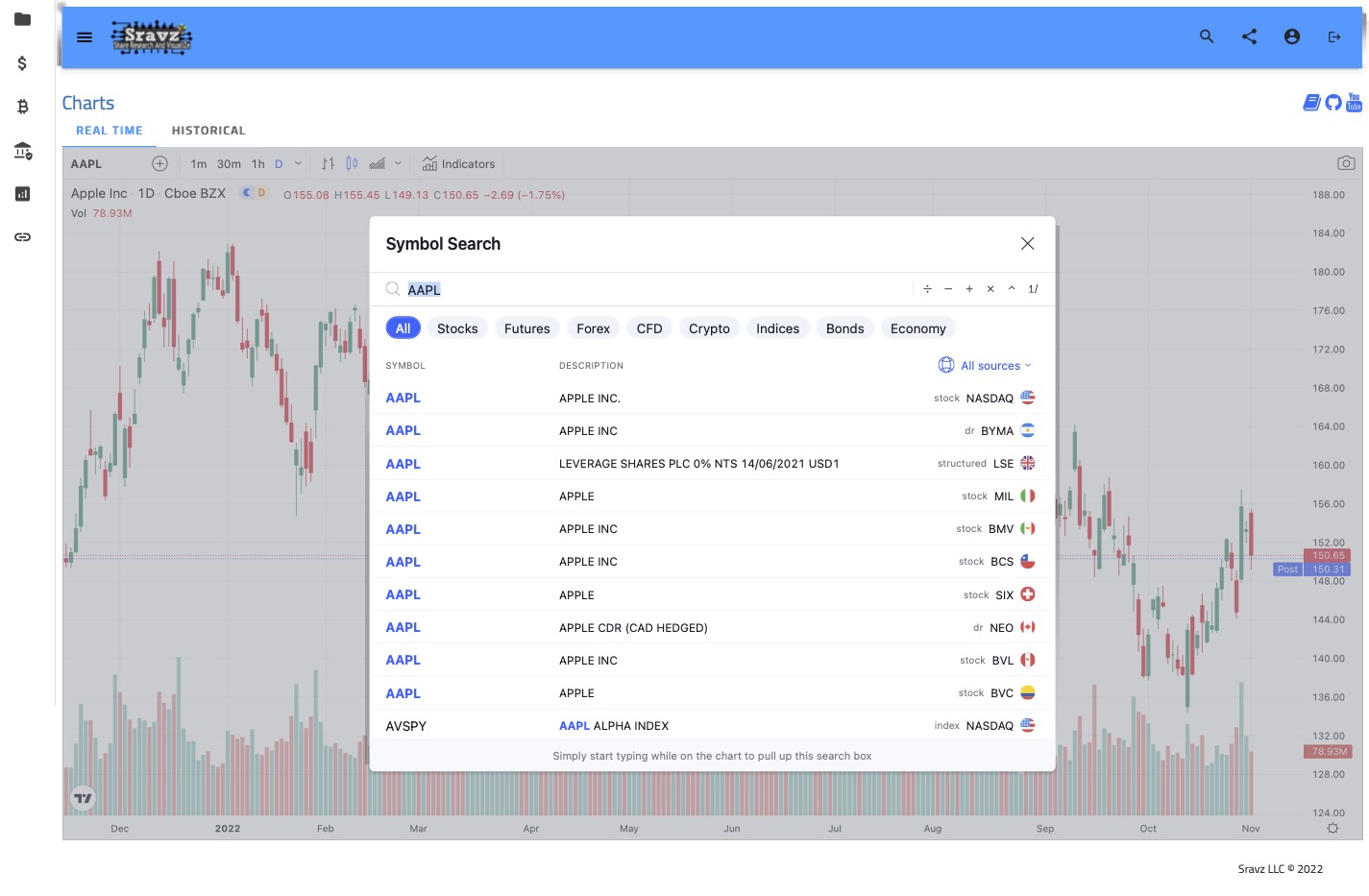

⚡ Real-Time Chart

Live streaming price data with sub-second updates for active trading.

📈 Interactive Charts

🔗 Launch Interactive ChartsFull-featured charting with technical analysis tools, overlays, and customizable time periods.

Technical Indicators

Overlays

| Indicator | Description |

|---|---|

| Bollinger Bands | Envelopes plotted at standard deviation levels above/below a moving average. Adjusts to volatility swings. |

| Price Channel | Bounded price range between two parallel lines. Can be horizontal, ascending, or descending. |

Trendlines

| Type | Description |

|---|---|

| Linear | Best-fit straight line for linear data showing steady increase/decrease |

| Quadratic | Second-order polynomial (y = a + bt + ct²) fitting |

| Cubic | Third-order polynomial (y = a + bt + ct² + dt³) fitting |

| Quartic | Fourth-order polynomial fitting for complex patterns |

| Quintic | Fifth-order polynomial for highly complex trends |

| Logarithmic | Fits ln(x) function - useful for rapid initial change then leveling |

| Exponential | Fits Ae^(kx) - all assets tend to change exponentially over time |

| Power Law | Y = kX^α - proportional relative changes |

Moving Averages

| Type | Description |

|---|---|

| Simple (SMA) | Average of all values: (x₁ + x₂ + … + xₙ)/n |

| Exponential (EMA) | Weighted average giving more weight to recent prices |

| Modified (MMA) | Includes sloping factor to catch up with price movements |

| Cumulative | Mean of all points up to and including current |

| Weighted | Assigns weightage based on relative importance |

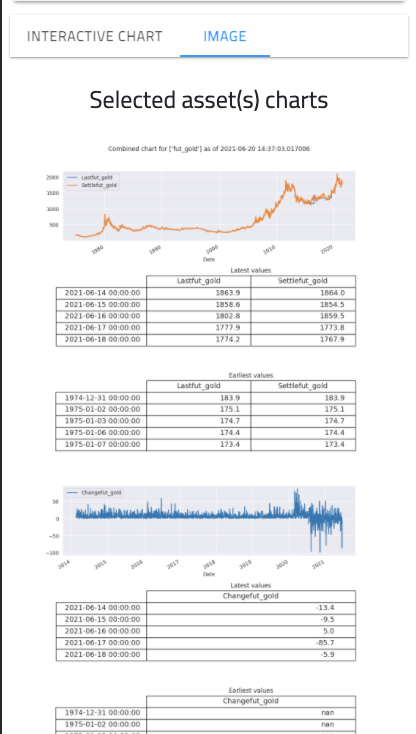

🖼️ Chart Image

Static image export showing comprehensive asset analysis including:

- Latest and earliest 5 days of last/settle prices

- Latest and earliest 5 days of price changes

- Latest and earliest 5 days of volume data

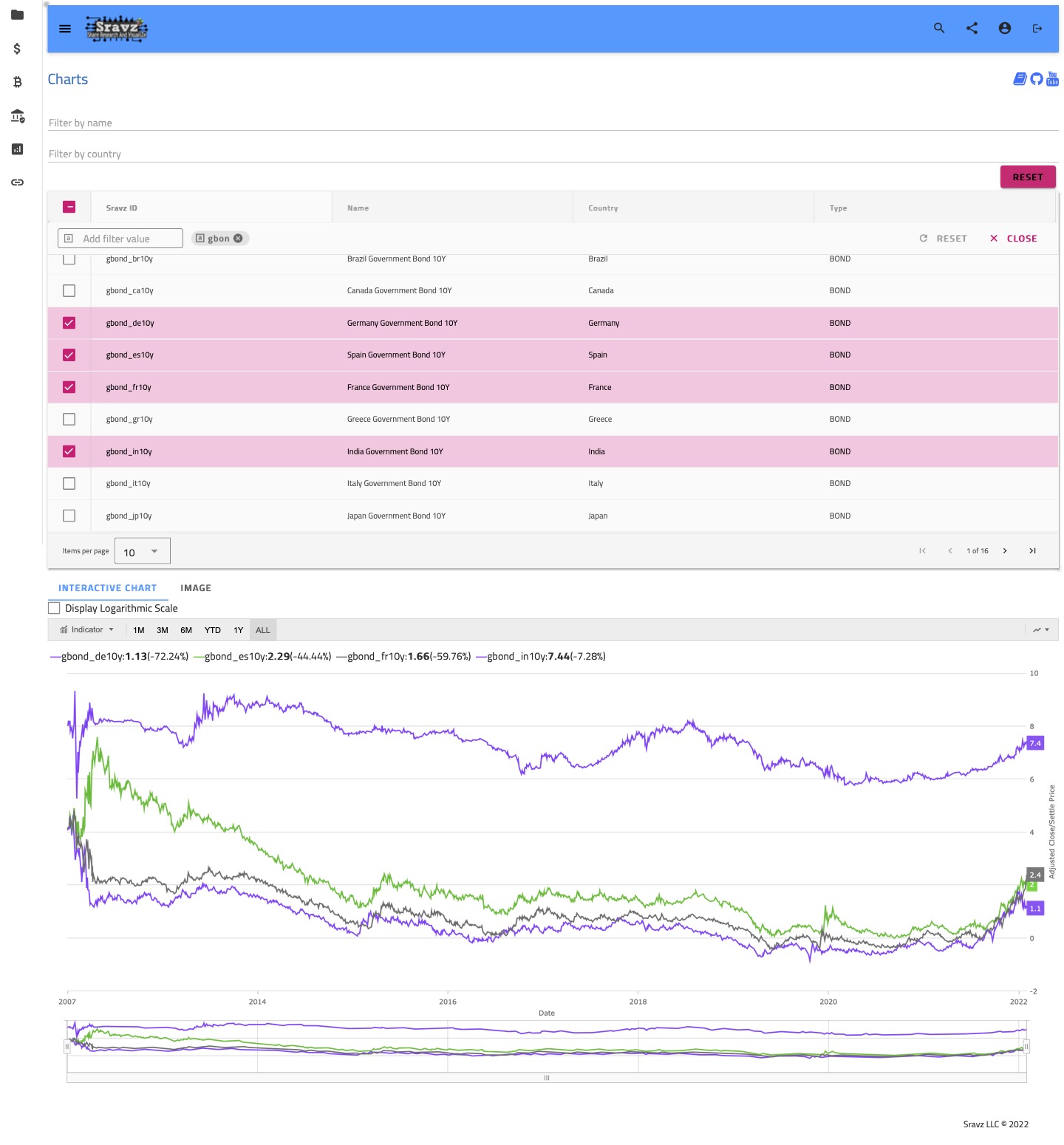

🔀 Cross Asset Analysis

Compare multiple assets across different asset classes to identify correlations, divergences, and relative performance.

Use Cases:

- Compare stock vs bond performance

- Analyze currency impact on commodities

- Track sector rotation patterns

- Identify safe-haven correlations

Quick Start

- Navigate to the Charts page at sravz.com/asset/all

- Select one or more assets from the grid (up to 10)

- Click Submit to generate charts

- Switch between Interactive Chart and Image tabs

- Use the toolbar to add indicators, change chart types, and zoom

💡

Pro Tip: Use logarithmic scale when comparing assets with vastly different price ranges to better visualize percentage changes.