Sravz Year To Date (YTD) Analysis

Peforms YTD returns analysis of assets.

Use Case

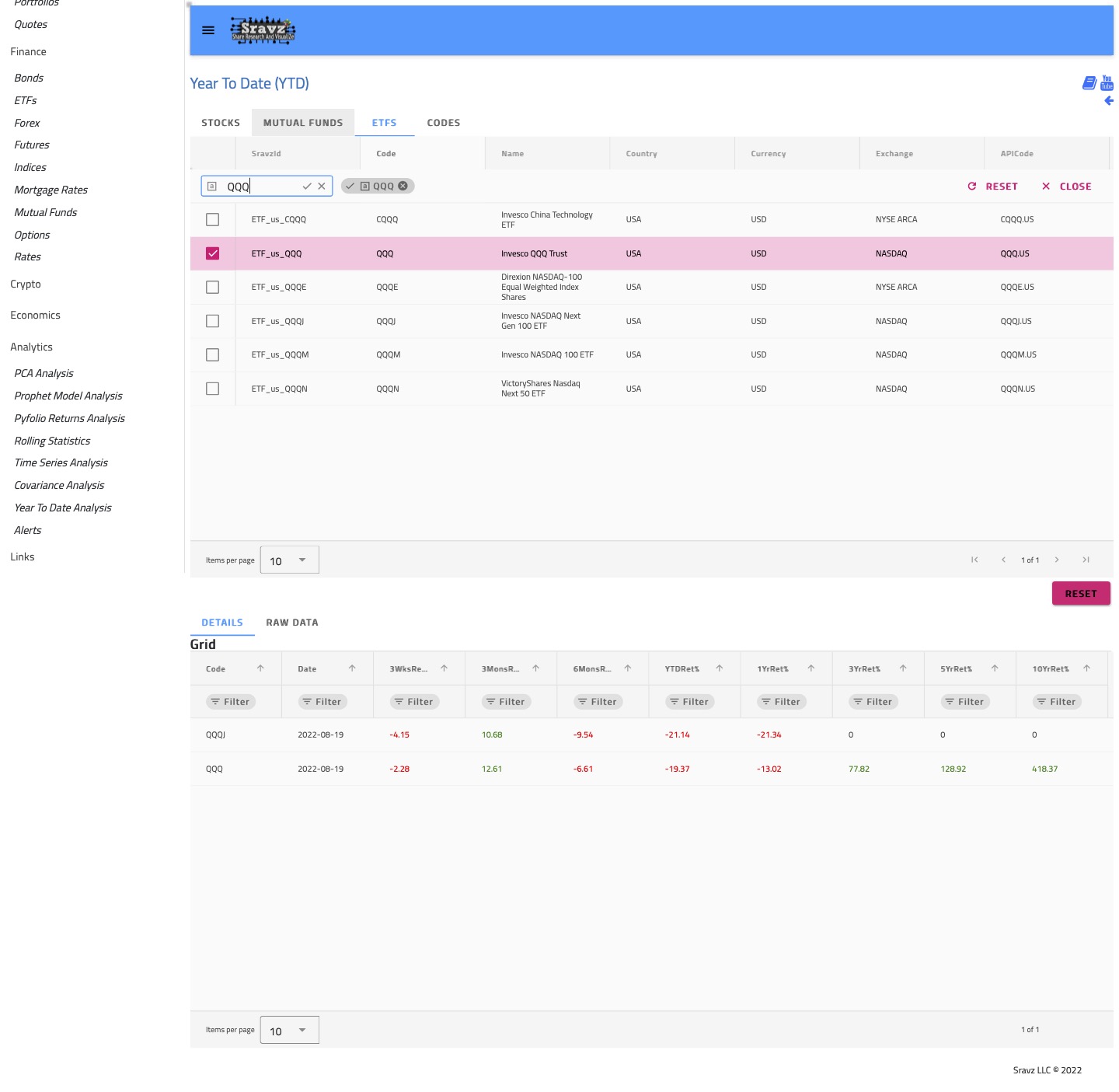

Sravz YTD Analysis Page can be used to check the 3 Weeks, 3 Months, 6 Months, YTD, 1 Yr, 3 Yr, 5 Yr, 10 Yr returns.

Sravz YTD Analysis Page can perform returns analysis of Stocks, Mutual Funds, ETFs and most of the US traded symbols.

Sravz Year To Date (YTD) - Screenshot

Sravz Year To Date (YTD) - Description

- YTD Returns

- YTD Statistics

- 3 Weeks Returns

- 3 Months Returns

- 6 Months Returns

- YTD Returns

- 1 Year Returns

- 3 Year Returns

- 5 Year Returns

- 10 Year Returns

- YTD Statistics

- Asset Classes

- Stocks

- Mutual Funds

- ETFs

- Most of the US traded symbols

- Data is displayed as a grid and raw json

- Grid format shows above statistics in a grid format

- Raw format shows data in JSON format

[{ "Code": "QQQJ", "Date_today": "2022-08-19", "Open_today": 26.62, "High_today": 26.62, "Low_today": 26.23, "Close_today": 26.31, "Adjusted_close_today": 26.31, "Volume_today": 311200, "Date_week_ago": "2022-08-12", "Open_week_ago": 27.08, "High_week_ago": 27.451, "Low_week_ago": 26.95, "Close_week_ago": 27.45, "Adjusted_close_week_ago": 27.45, "Volume_week_ago": 157000, "Date_three_months_ago": "2022-05-24", "Open_three_months_ago": 24.25, "High_three_months_ago": 24.26, "Low_three_months_ago": 23.57, "Close_three_months_ago": 23.81, "Adjusted_close_three_months_ago": 23.7719, "Volume_three_months_ago": 255317, "Date_six_months_ago": "2022-02-28", "Open_six_months_ago": 28.97, "High_six_months_ago": 29.27, "Low_six_months_ago": 28.685, "Close_six_months_ago": 29.16, "Adjusted_close_six_months_ago": 29.0849, "Volume_six_months_ago": 205434, "Date_year_start_date": "2022-01-03", "Open_year_start_date": 33.63, "High_year_start_date": 33.7037, "Low_year_start_date": 33.23, "Close_year_start_date": 33.45, "Adjusted_close_year_start_date": 33.3639, "Volume_year_start_date": 341906, "Date_one_year_ago": "2021-08-23", "Open_one_year_ago": 33.36, "High_one_year_ago": 33.82, "Low_one_year_ago": 33.36, "Close_one_year_ago": 33.79, "Adjusted_close_one_year_ago": 33.4457, "Volume_one_year_ago": 234195, "Date_three_years_ago": "", "Open_three_years_ago": 0, "High_three_years_ago": 0, "Low_three_years_ago": 0, "Close_three_years_ago": 0, "Adjusted_close_three_years_ago": 0, "Volume_three_years_ago": 0, "Date_five_years_ago": "", "Open_five_years_ago": 0, "High_five_years_ago": 0, "Low_five_years_ago": 0, "Close_five_years_ago": 0, "Adjusted_close_five_years_ago": 0, "Volume_five_years_ago": 0, "Date_ten_years_ago": "", "Open_ten_years_ago": 0, "High_ten_years_ago": 0, "Low_ten_years_ago": 0, "Close_ten_years_ago": 0, "Adjusted_close_ten_years_ago": 0, "Volume_ten_years_ago": 0, "Adjusted_close_week_ago_return_percent": -4.15, "Adjusted_close_three_months_ago_return_percent": 10.68, "Adjusted_close_six_months_ago_return_percent": -9.54, "Adjusted_close_year_start_date_return_percent": -21.14, "Adjusted_close_one_year_ago_return_percent": -21.34, "Adjusted_close_three_years_ago_return_percent": 0, "Adjusted_close_five_years_ago_return_percent": 0, "Adjusted_close_ten_years_ago_return_percent": 0 }]