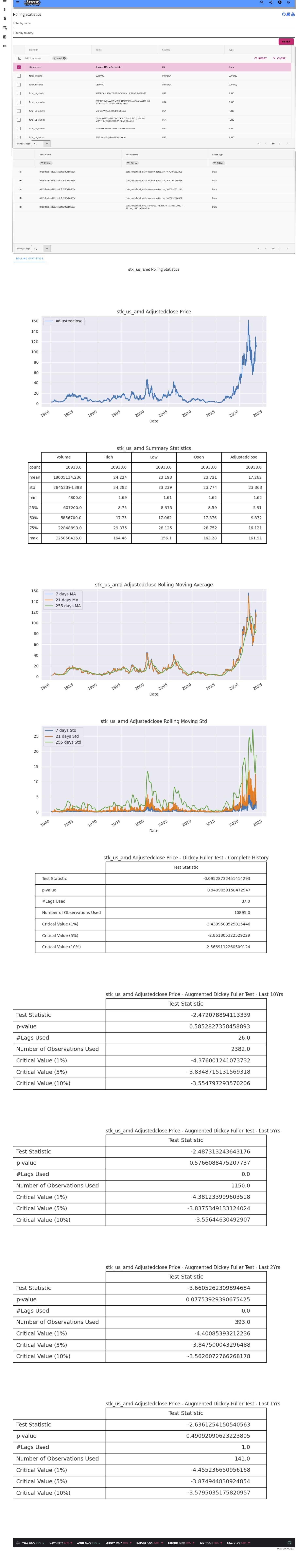

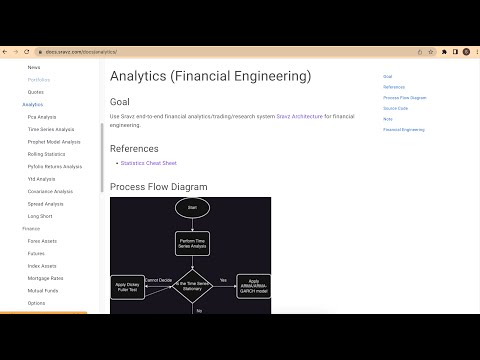

Rolling Statistics

Peforms rolling statistics analysis on assets. Analysis on Portfolios not supported yet.

Rolling Statistics - Screenshot

Video explanation of the code

Source Code

Use case

Perform Dicky Fuller Test to check if a timeseries is stationary or non stationary

Stationary Process: A process that generates a stationary series of observations.

Stationary Model: A model that describes a stationary series of observations.

Trend Stationary: A time series that does not exhibit a trend.

Seasonal Stationary: A time series that does not exhibit seasonality.

Strictly Stationary: A mathematical definition of a stationary process, specifically that the joint distribution of observations is invariant to time shift.

- Last Price Chart displays asset last price

- Summary statistics displays statistics on the asset timeseries.

- Count: Show number of data points in the timeseries

- Mean: Mean last price

- Std: Std last price

- Min: Min last price

- 25%: First quartile of the last price distribution

- 50%: Second quartile of the last price distribution

- 75%: Thrid quartile of the last price distribution

- Max: Max last price

- Displays moving average plots.

- 7 days MA: 7 days Moving Average Plot

- 21 days MA: 21 days Moving Average Plot

- 255 days MA: 255 days Moving Average Plot

- Displays moving std plots.

- 7 days std: 7 days Moving Standard Deviation Plot

- 21 days std: 21 days Moving Standard Deviation Plot

- 255 days std: 255 days Moving Standard Deviation Plot

- Augmented Dickey-Fuller unit root test.

- Auto Regressive Model with no time trend

$$ y_{t}=\rho y_{t-1}+u_{t}\, $$

$$ \Delta y_{t}=(\rho -1)y_{t-1}+u_{t}=\delta y_{t-1}+u_{t} $$

Unit Root is present if:$$ \delta = 0 $$

- The null hypothesis of the test is that the time series can be represented by a unit root, that it is not stationary (has some time-dependent structure).

- A stationary timeseries will have a constant mean, standard deviation and no sesonality

- The alternate hypothesis (rejecting the null hypothesis) is that the time series is stationary.

- p-value is the smallest level of significance at which the null hypothesis would be rejected

- p-value > 0.05: Fail to reject the null hypothesis (H0), the data has a unit root and is non-stationary.

- p-value <= 0.05: Reject the null hypothesis (H0), the data does not have a unit root and is stationary.

- Auto Regressive Model with time trend

$$ \Delta y_t = \alpha + \beta t + \gamma y_{t-1} + \delta_1 \Delta y_{t-1} + \cdots + \delta_{p-1} \Delta y_{t-p+1} + \varepsilon_t, $$

where $$\alpha$$ is a constant,$$ \beta $$

the coefficient on a time trend and$$ p $$

the lag order of the autoregressive process. Imposing the constraints$$ \alpha = 0\ \&\ \beta = 0 $$

corresponds to modelling a random walk and using the constraint$$ \beta = 0 $$

corresponds to modeling a random walk with a drift.

- Auto Regressive Model with no time trend