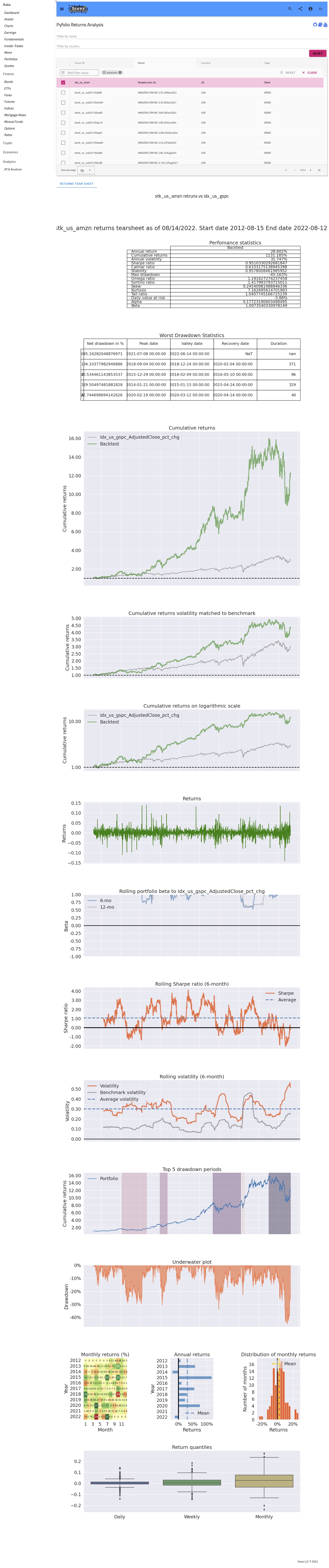

Pyfolio Returns Analysis

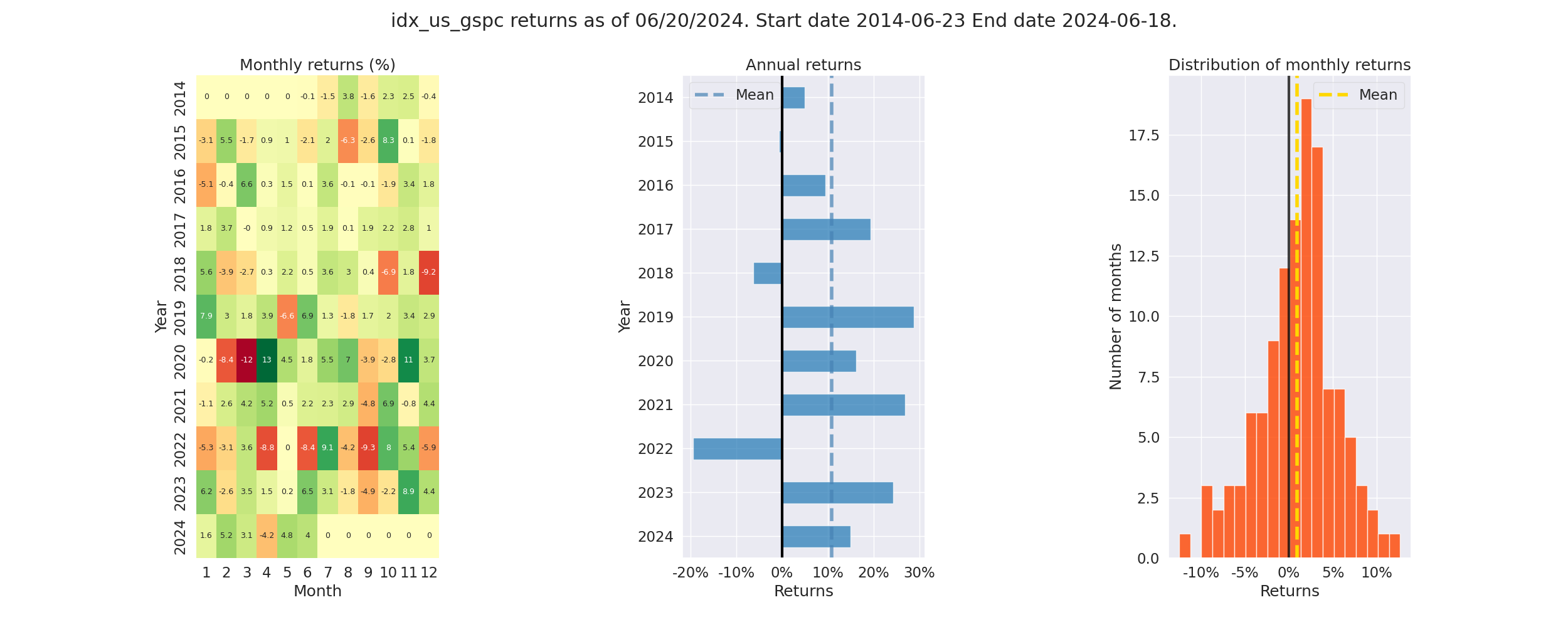

Performs returns analysis of assets and portfolios for last 10 yrs. S&P 500 returns are used as benchmark.

Use Case

Sravz Pyfolio Returns Analysis page can be used compare the performance of your stock/bond/etf w.r.t to S&P 500 returns over last 10 yrs.

Pyfolio Returns Analysis - Screenshot

Video explanation

Pyfolio Returns Analysis - Description

- Returns tear sheet

- Peformance statistics

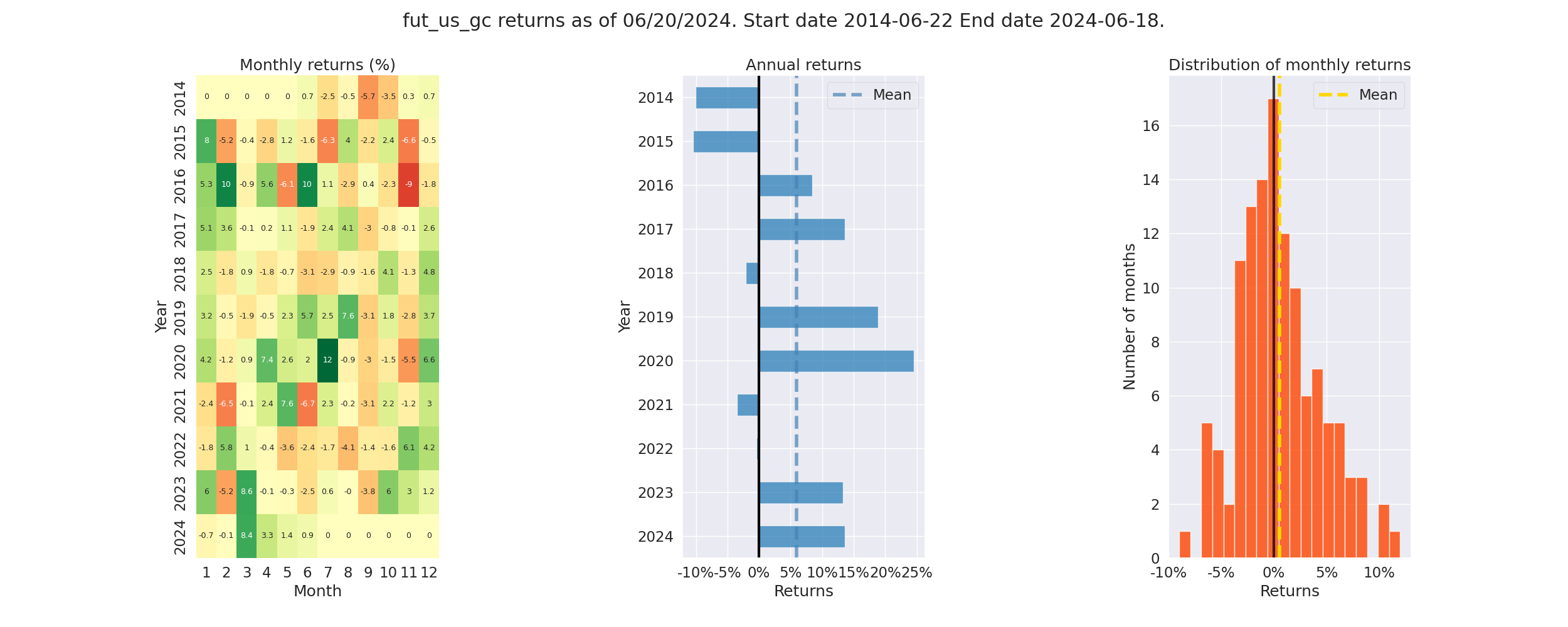

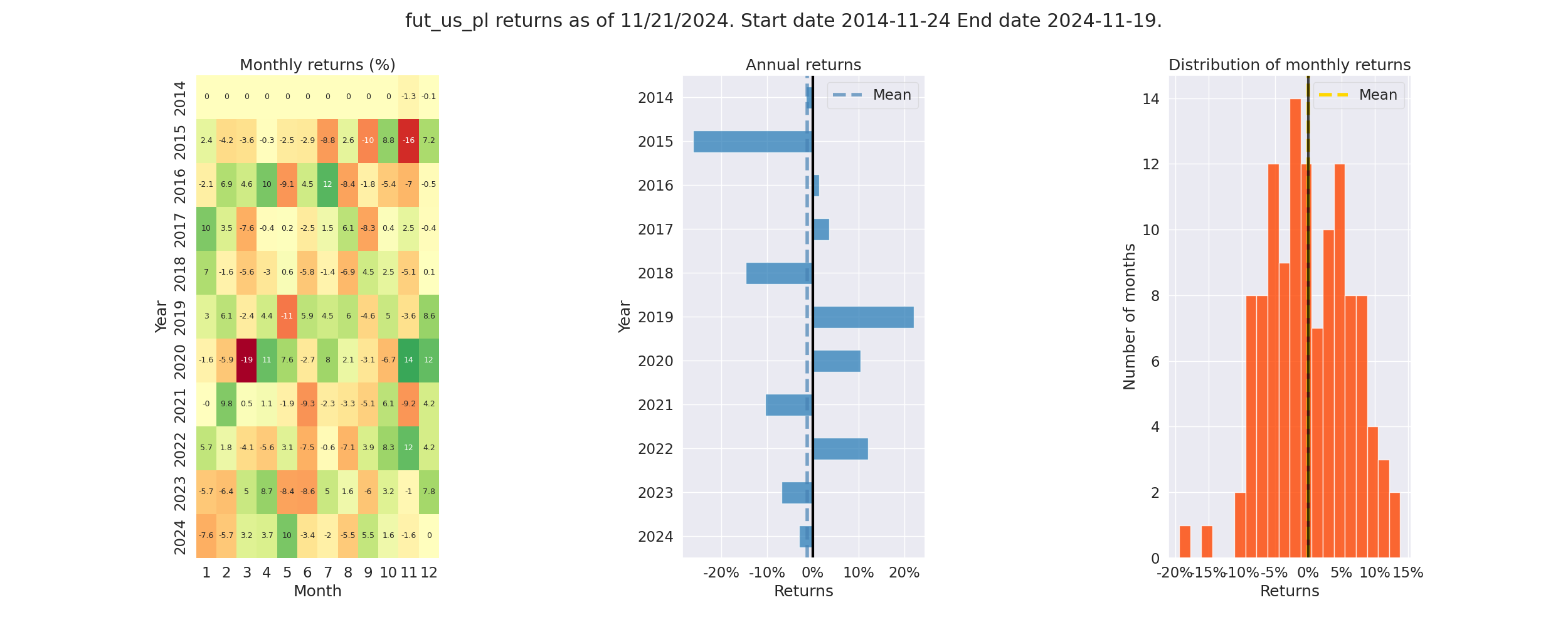

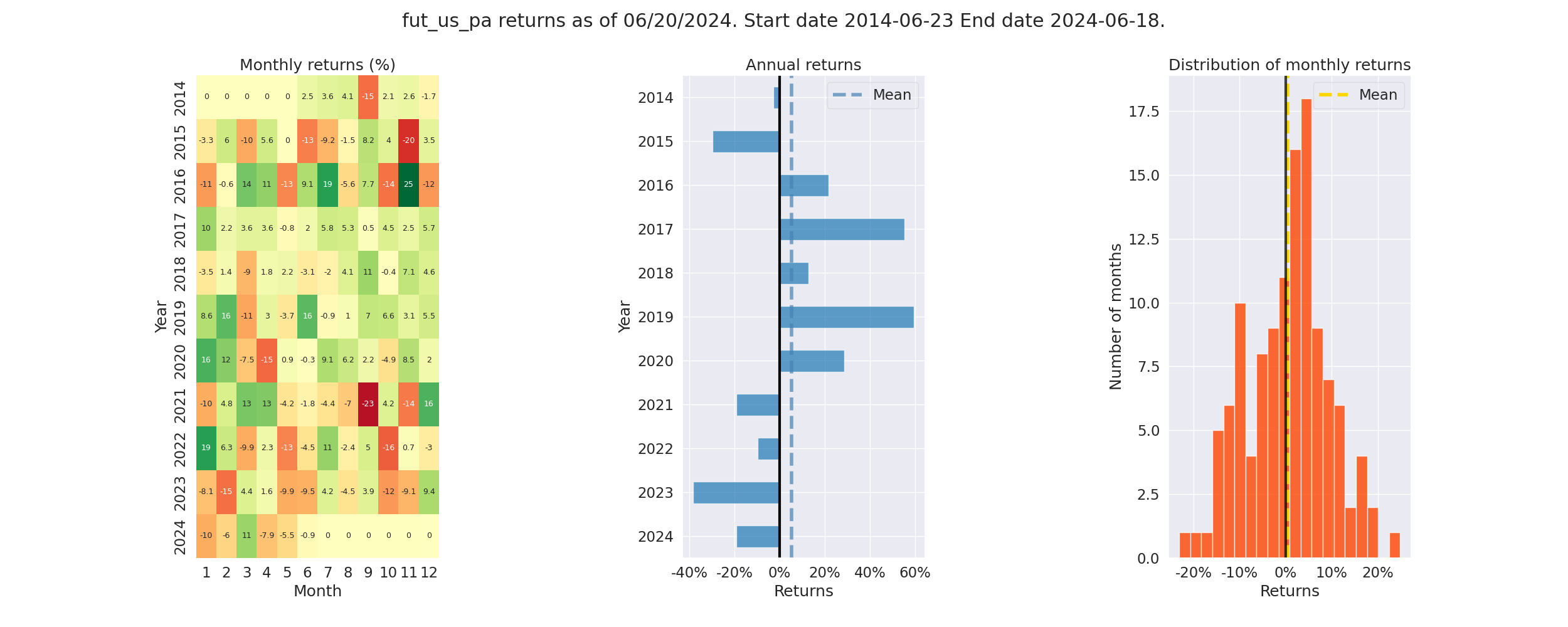

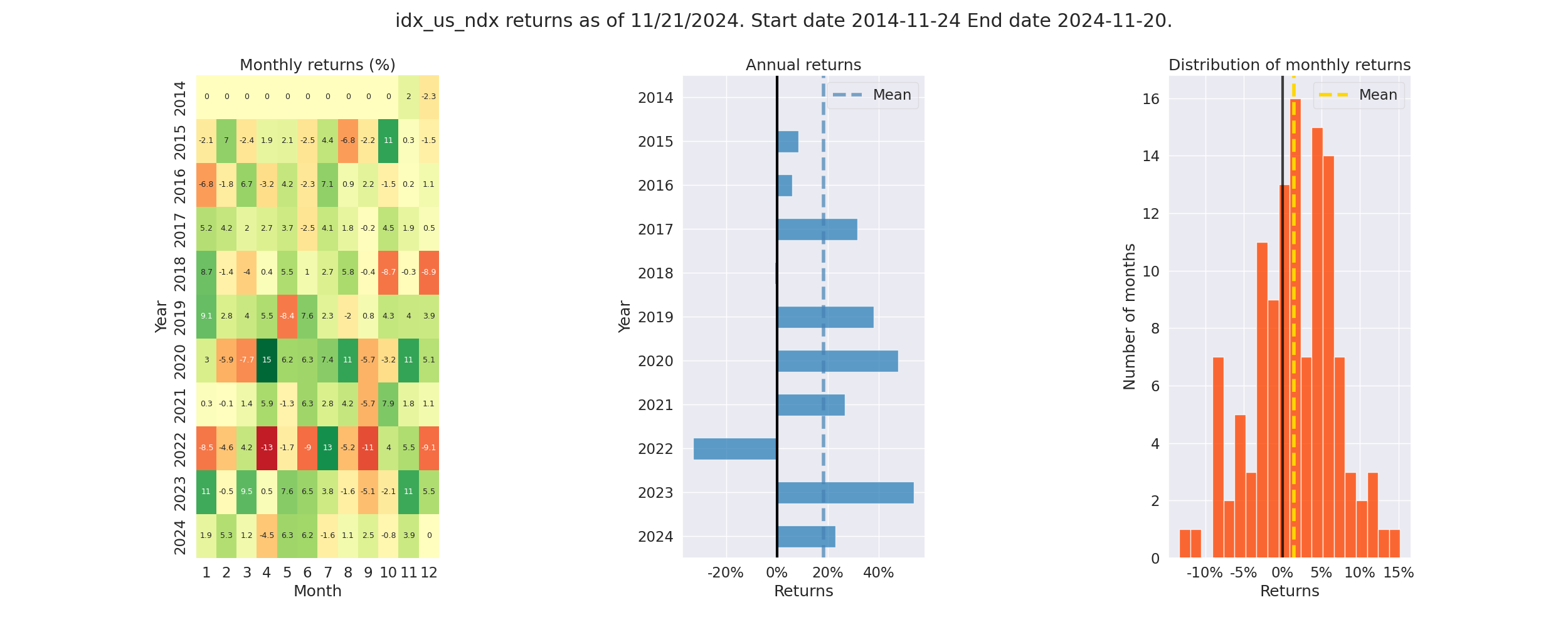

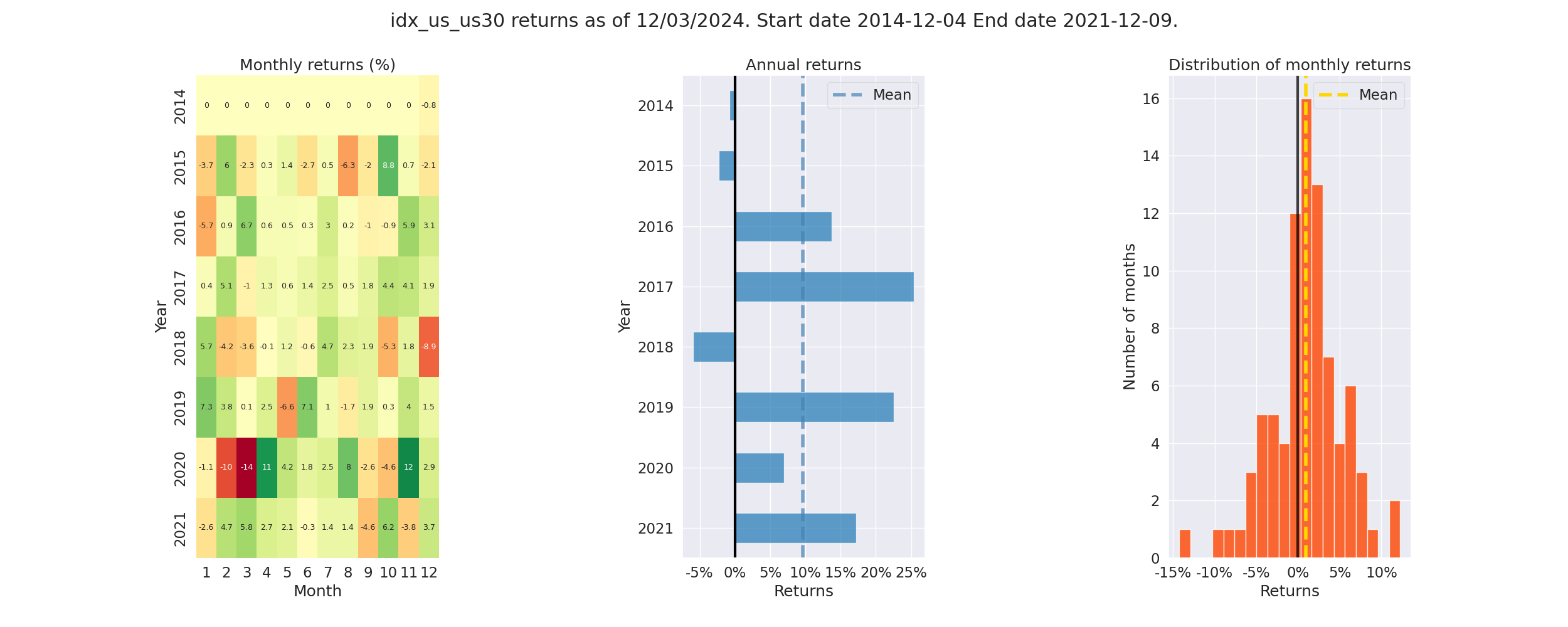

- Annual Returns: % annual returns

- Cum Returns Final: % cummulative returns in last 10 years

- Annual volatility: % annual volatility (risk)

- Sharp Ratio: Compares performance of an asset w.r.t risk free asset.

- Calmar Ratio:

- Compounded annual growth rate divided by the maximum drawdown.

- The maximum drawdown is the maximum peak to trough of the returns measured over a three year period.

- Stability of TimeSeries:

- Determines R-squared of a linear fit to the cumulative returns.

- Computes an ordinary least squares linear fit and returns R-squared.

- Max drawdown:

- Maximum loss that occurrend on the portfolio

- Omega Ratio:

- Defined as the probability weighted ratio of gains versus losses for some threshold return target

- Threshold is set to 0

- Higher Omega Ratio is good for the portfolio

- Sortino Ratio:

- Sharp Ratio uses complete volatility in the denominator. Upside + Downside volatility

- Sortino Ratio uses only Downside volatility in the denominator

- Skew:

- Positive Skew: Positive skew indicates that the tail is on the right side of the distribution

- Negative Skew: Indicates that the tail is on the left side of the distribution

- Zero Skew: Normal distribution. Tails are equal on both side of the distribution

- Kurtosis:

- Higher kurtosis corresponds to more frequent extreme deviations (or outliers), as opposed to frequent modestly sized deviations.

- Kurtosis of Normal distribution is 3

- Tail ratio:

- Determines the ratio between the right (95%) and left tail (5%).

- For example, a ratio of 0.25 means that losses are four times as bad as profits.

- Common Sense Ratio:

- Multiplication of the tail ratio and the Gain-to-Pain-Ratio – sum(profits) / sum(losses)

- Information Ratio:

- (Portfolio returns - Benchmark Returns)/Tracking Error

- Tracking error = STD of difference between portfolio and benchmark returns

- Show how portfolio manager provides extra information to achieve returns over benchmark returns

- Value at risk:

- Value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period.

- Alpha:

- Represents by how much percent the portfolio beats the benchmark

- Zero alpha indicates the portfolio perfectly tracks the benchmark index

- Beta:

- Shows how much risk the asset/portfolio will add (or potentially subtract) from a diversified portfolio.

- (Covariance of Asset/Portfolio Returns, Market returns)/Variance of Market Returns

- Peformance statistics

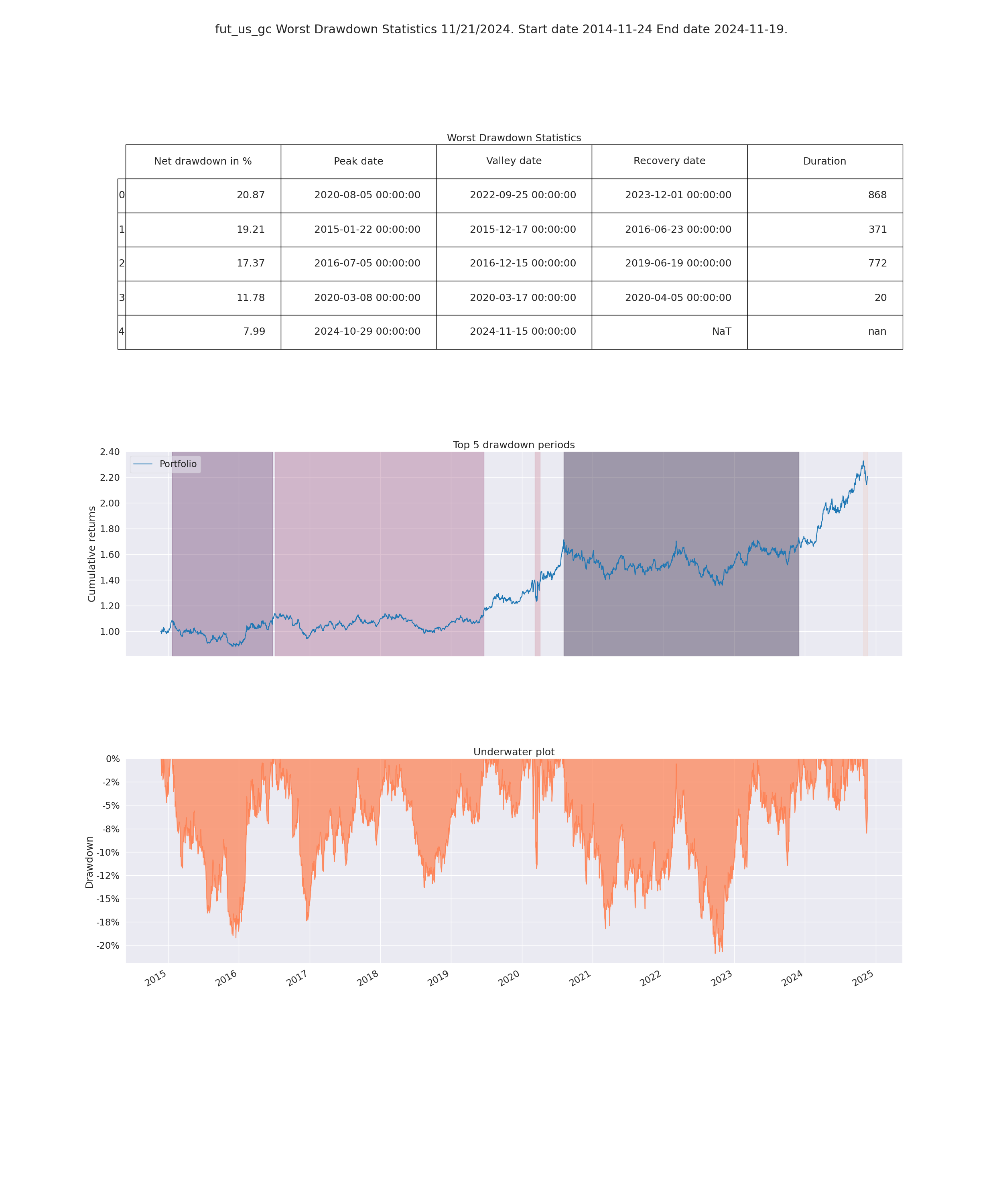

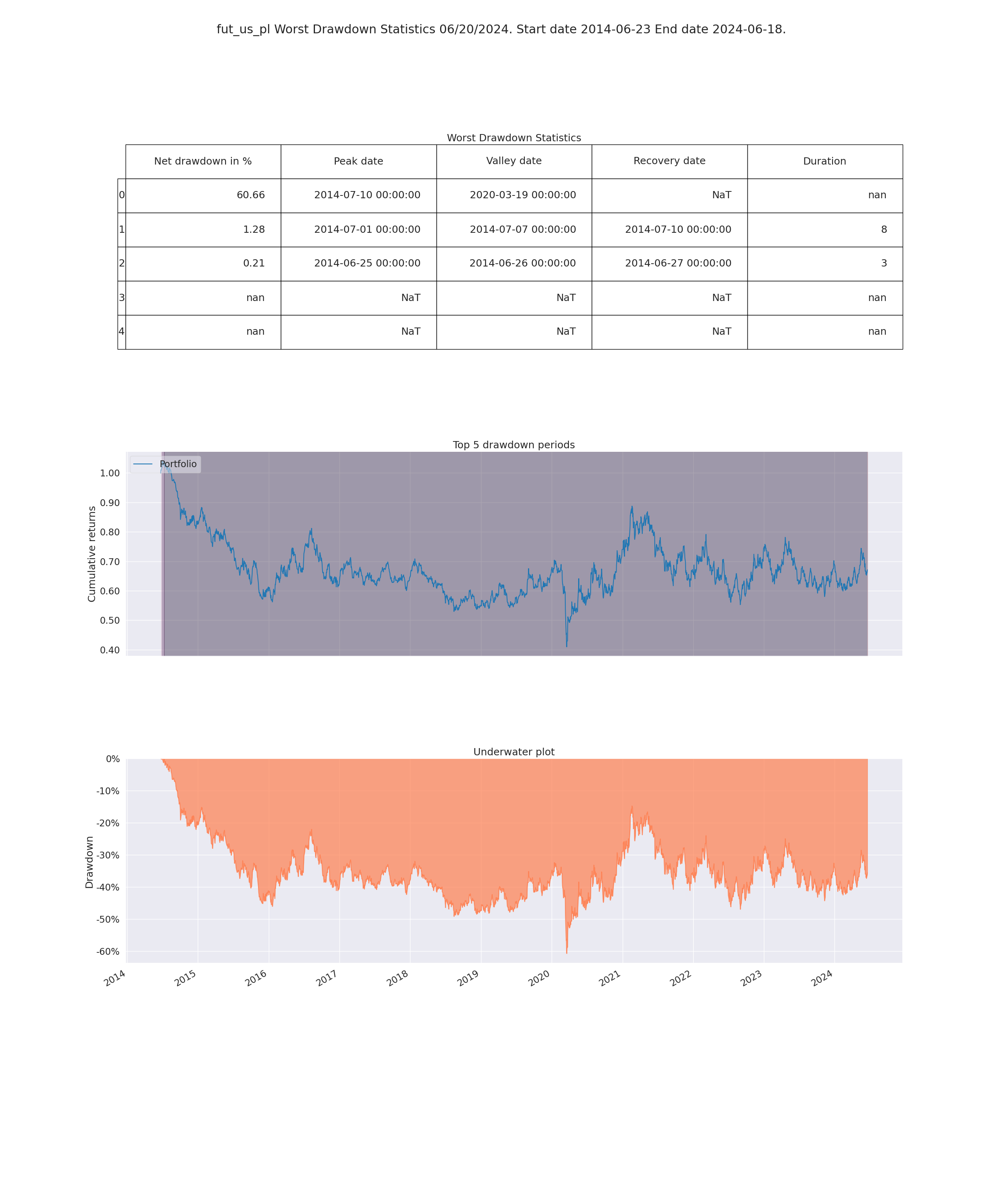

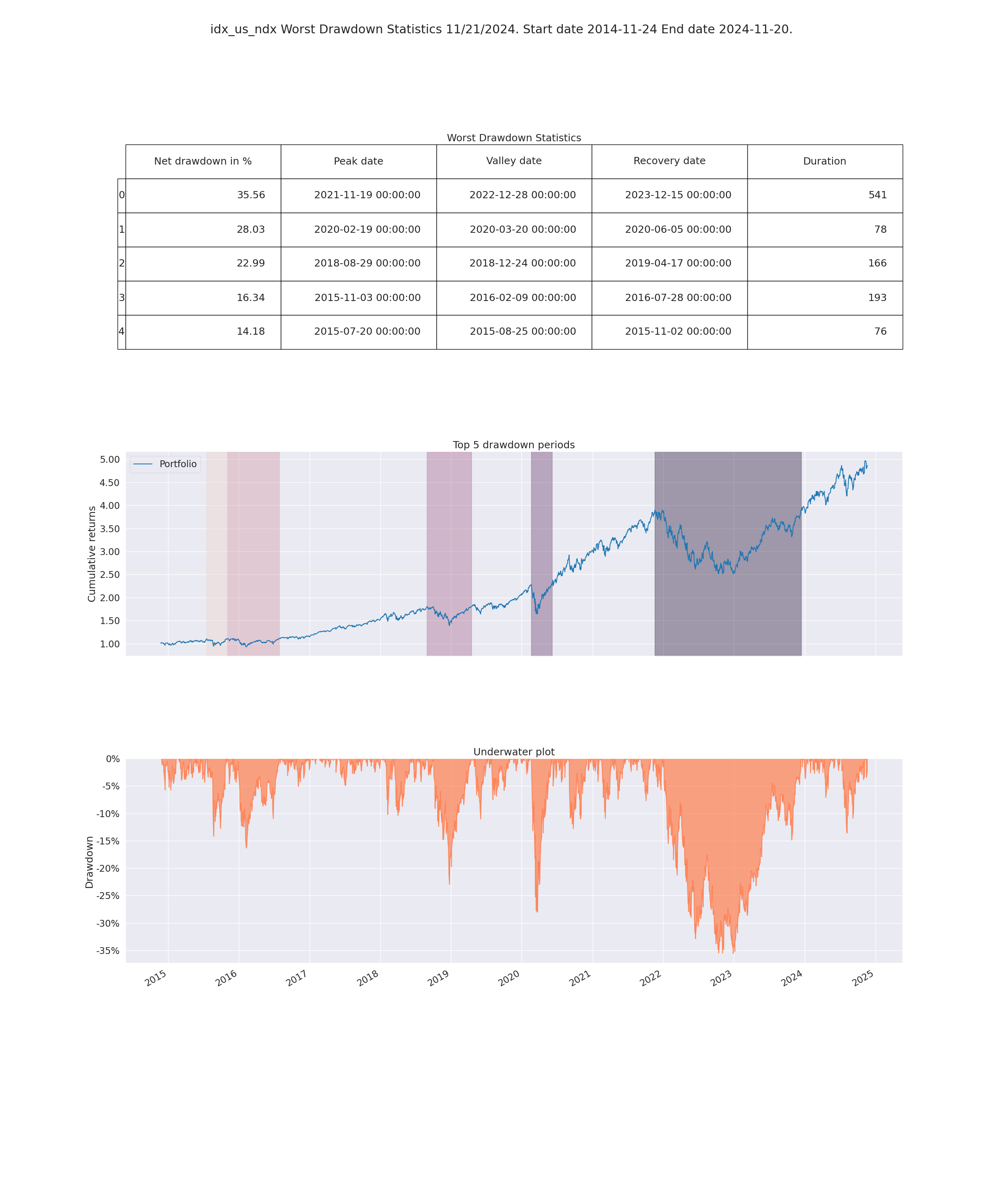

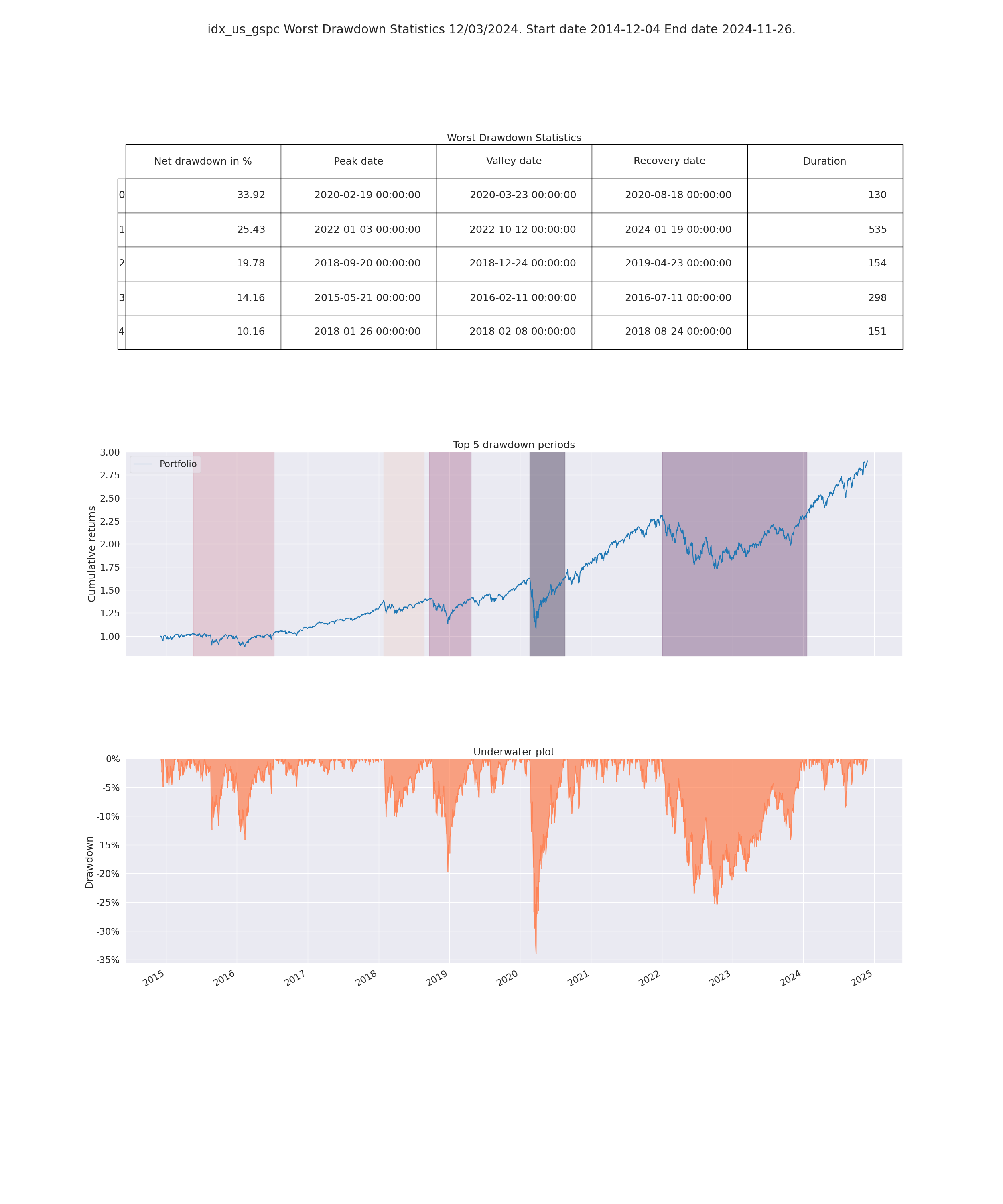

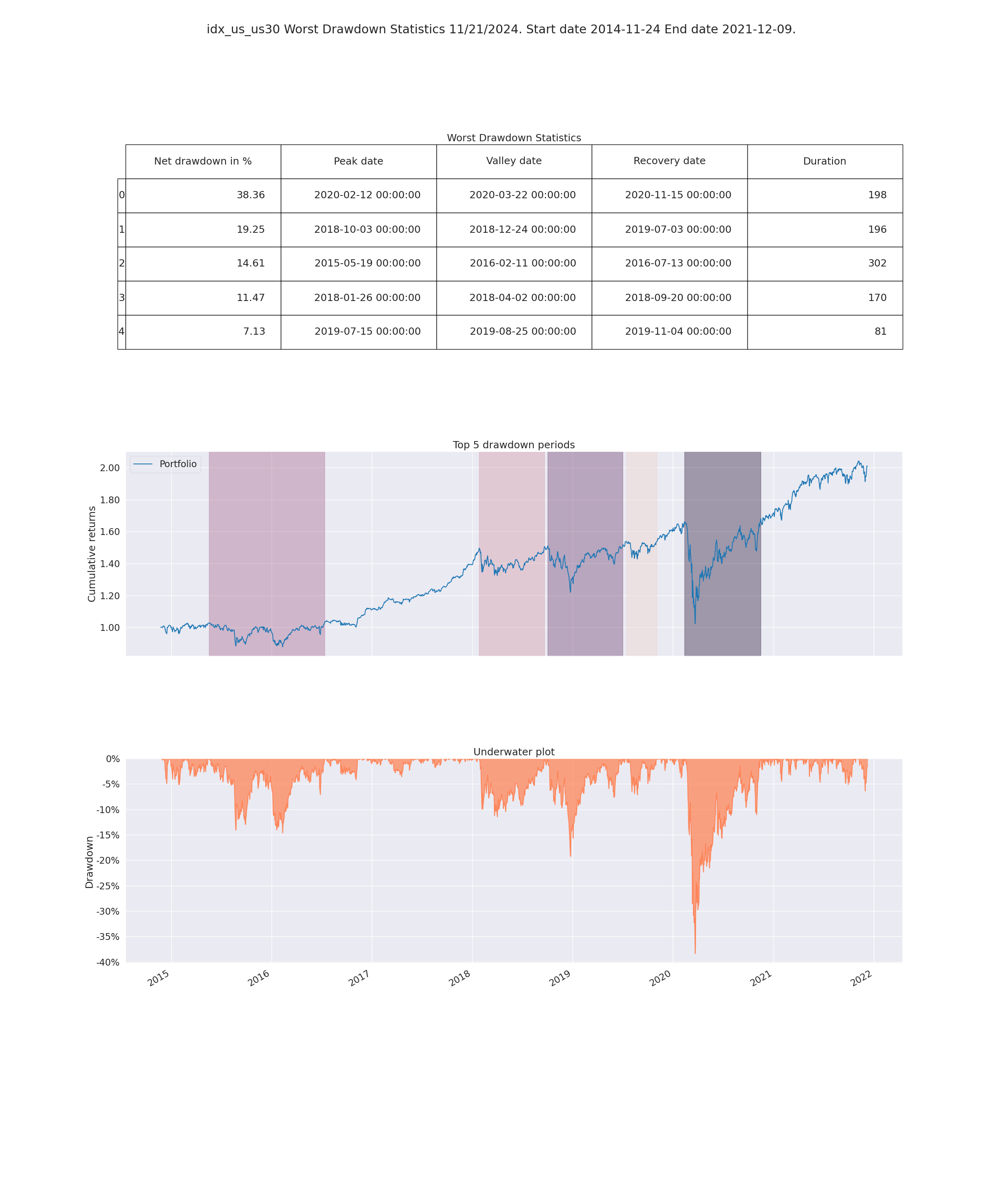

- Worst Drawdown Statistics

- Display loss experienced during each loss period